The Entrepreneurs

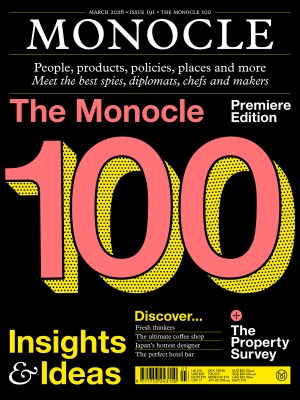

The third issue of Monocle’s The Entrepreneurs is brimming with 100 tips for success. We’ve canvassed global leaders, thinkers and doers for their insights and advice on everything from improving your office to winning in new markets. Not sure what your next step should be? We look at how to get a job, find your brand voice and where best to locate your next start-up.

In This Issue

Oops! No content was found.

Looks like we no longer have content for the page you're on. Perhaps try a search?

Return Home